The old saying goes the devil is in the details. There is no truer place than where money is concerned. The reason is simple: whoever made the game and plays the game is probably going to win. While the Internal Revenue Service is not necessarily into “winning”, they do have some details that are worth knowing about income taxes.

The old saying goes the devil is in the details. There is no truer place than where money is concerned. The reason is simple: whoever made the game and plays the game is probably going to win. While the Internal Revenue Service is not necessarily into “winning”, they do have some details that are worth knowing about income taxes.

They are not necessarily into pulling the wool over taxpayer’s eyes. Though, most people do not speak “accounting”, and so some of the terms just get lost in the part of the brain that drops any scary money words into the depths of the “tax” bucket in the crevasses of the brain.

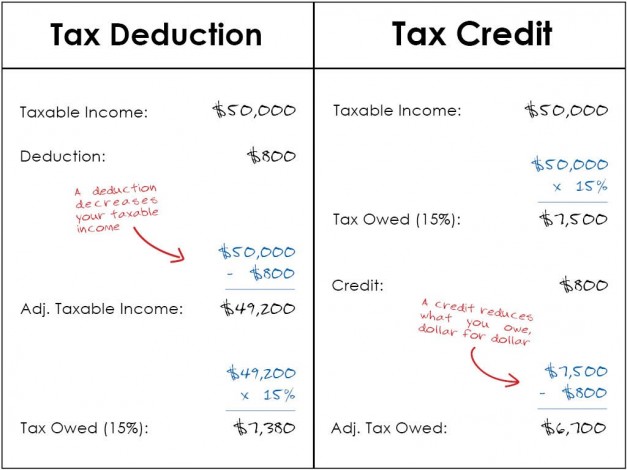

The first is the difference between tax credits and tax deductions. Many people use them interchangeably, but they are not one in the same. True, both can cut your tax bill, they refer to where they take place in the process of tax preparation.

How Come That Rich Guy Pays The Same Taxes You Pay?

This is where deductions factor into the game. Tax deductions reduce the taxable income. Common tax deductions might include home office deduction.

Say that you work 9 to 5, five days a week. Then your employer is paying to keep the lights on, to supply air-conditioning and/or heating, paying rent, supplying pens, paper, Internet and phone access, business insurance, computers, and that cranky and unruly photocopier. They pay a lot in overhead to operate an office, in other words.

The office is a tax deduction. In exchange for working, you may receive perks such as free coffee, fresh spring water, and a nice cafeteria that is subsidized by your employer. You guessed it, those might be deductions for your employer as well.

If your wife, on the other hand, works for herself, then she probably has taken over some portion of the home for her home office. She qualifies for a home office deduction. It must be a place that is used solely for her work.

Yet for you, if you were to file your taxes separately it would seem like you are paying nearly double in taxes. She is self-employed and paying something hovering near 20%, and you are paying 40%. Surely there has to be a saving grace for you.

Tax Credits

Let’s say that you are environmentally friendly and are proudly a tree hugger. You have a home that you are busily fitting for every new high-energy efficiency product you can find. Now we are talking.

You are onto your piece of the tax relief pie here. While you may owe a higher percentage than your wife, if you were filing separately, you have some relief. It is in the form of tax credits.

Say you live in a state that is as energy efficient conscious as you are, and they are offering credits for driving the greenest cars on the market. Ch-aching. You may find yourself with a few thousand dollars off your tax bill.

Then factor in all the credits from the EPA for buying all those Energy STAR appliances, windows, and installing a solar heating system on your home. You guessed it, you are in tax credit land now. Look for child tax credits, depending upon the tax bracket you are in with your wife.

Tax deductions and tax credits are good to be aware of because they take some of the bite out of tax time. Deductions take that income down a bit while the tax credit slashes the amount that you owe to the Federal government. The same thinking applies for state and local taxes too.

Overlooked

Overlooked